If you’re new to Stanford Federal Credit Union or just curious about our financial position, I want to reassure you that your money is safe with us.

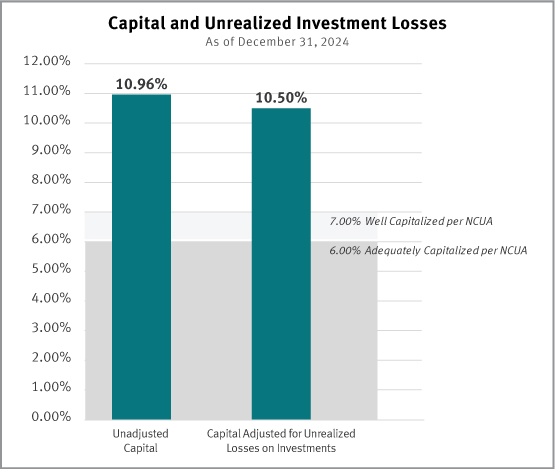

- Our capital level at 10.96% (as of 12/31/24) is well above the “well-capitalized” threshold of 7.0% set by our federal regulators.

- In 2024 (as of 12/31/24), in an economic climate where many of our peers lost net deposits, Stanford FCU increased our deposits by 6.2% and grew our net membership by 3.2%.

- We continue to be a conservatively managed financial institution you can trust with your savings.

I’m passionate about the credit union difference and want to take this opportunity to remind you what it means for you. As a credit union, we’re different than a bank because we’re structured and operate as a non-profit financial cooperative. The foundation of this structure is that we don’t distribute net income to a small group of investors or shareholders. It’s important that we make net income to build capital for safety and soundness purposes. However, beyond that, our focus is on expanding our service offerings and providing strong value to you. Our value comes to you in the form of competitive rates and very minimal fees—much lower than our for-profit competition and very low compared to our credit union peers. Our value is also reflected in our service to you—we strive to be reachable and responsive!

As a financial cooperative, pricing and rebates are stronger the more you do with us, rewarding you as you deepen your relationship with us. If you’re not getting our best rates, reach out to our member care team for assistance.

We hope you feel reassured that your money is safe and secure at Stanford FCU. We’ve been in business serving the Bay Area since 1959, and we work every day to strengthen the trust our members have in us.