Financial Tips

Psst, it’s not just grandpa getting scammed!

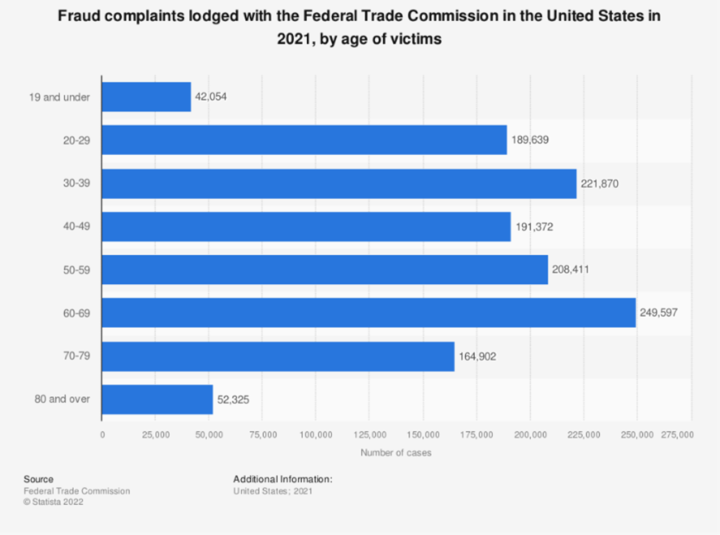

Contrary to popular belief, individuals ages 30-39 were the second largest age group to report fraud to the Federal Trade Commission (FTC) in 2021 (individuals ages 60-69 were number one). The age gap has narrowed for scam victims, as shown on the Statista chart below. Even more alarming, younger people reported losing money to fraud more often than older people, although individuals 70+ lost more money.

According to the FTC report, the top 10 reported fraud categories were:

- Imposter scams

- Online shopping and negative reviews

- Prizes, sweepstakes and lotteries

- Internet services

- Business and job opportunities

- Telephone and mobile services

- Investment related

- Health care

- Travel, vacations and timeshare plans

- Foreign money offers and fake check scams

It’s easy to see why younger people are falling victim so often—online shopping, prizes, job opportunities and fake check scams are likely more appealing to them than to seniors. Bank transfers and payments (e.g., Zelle® and wire transfers) accounted for $756 million in these losses, followed by Cryptocurrency ($750 million).

So what’s the starting point for all this fraud? According to the 5.7 million reported cases, the contact methods most reported were:

- Phone call (36%)

- Text (21%)

- Email (14%)

- Website or Apps (10%)

- Social Media (9%)

- Other (6%)

- Mail (2%)

- Online Ad or Pop-up (2%)

Clearly you can’t stop using your phone or email, but there are steps you can take to protect yourself from fraud. Read the FTC’s tips on how to avoid a scam.

Source: Consumer Sentinel Network Data Book 2021, Published by the Federal Trade Commission, February 2022.