Free checking

Welcome to Stanford Federal Credit Union

We’ve got rewards for you! New members get insider access to our best financial benefits! You also get rewarded with up to $620 in cash or gift cards just by doing everyday banking.

The rewards

New members earn up to $620

Log in to Digital Banking to activate your special offers and start earning today! CashBack+ makes it fun and easy to get rewarded by completing simple tasks like signing up for direct deposit, using your debit card, and choosing eStatements (but hurry—you must activate each activity first if you want to earn the cash!).

Start earning!

- Go to CashBack+ in Digital Banking

- Click Activate for each of the activities you want to complete

- Your cashback will appear in your CashBack+ wallet shortly after you meet each requirement

- Transfer your cashback to your account as cash

View disclosures

Enjoy your Ambassador discounts and rewards

Members who do their everyday banking with us get extra benefits, and as a new member you get to sample those perks! These rewards last for a full three months, and that’s plenty of time for you to qualify as an Ambassador and keep the perks.

Start using your rewards!

These rewards and discounts are yours to enjoy while you’re in your New Member Period, so open a certificate to enjoy a higher rate* or use any ATM in the world for free.

It doesn’t take a lot of money to be an Ambassador once your New Member Period ends, you just need to do your everyday banking with us! See how

*You must meet the Ambassador requirements before the end of your New Member Period to keep the higher rate on your certificate.

How long do these rewards last?

Both your New Member Period Ambassador rewards and your CashBack+ rewards start the day you open your membership PLUS the following three full calendar months. For example, if you joined January 1, your rewards would last until April 30 (120 days). If you joined on January 31, your rewards would last until April 30 (90 days).

Although the initial Cashback+ rewards will expire, more offers will come in the future. Keep checking Digital Banking to see new offers and earn more rewards!

The Ambassador rewards can be extended with qualifying account activities.

How can I extend my rewards?

Keep your Ambassador rewards going by having the following monthly activities on your checking (spending) account:

- Minimum $2,500 in monthly payroll OR $1,250 social security direct deposit1 OR $1,000 in monthly debit card purchases

- One to two key qualifiers:

- Minimum 20 debit card purchases per month

- Deposit accounts with monthly combined $25,000+ balances (excluding certificates)2

- Credit card3

- Consumer loan: Vehicle or Personal loan

- First mortgage (counts as two!)

- Second mortgages and HELOCs4

- Investment account with Stanford Federal Investment Services5

Members who meet one key qualifier will enjoy Partner benefits. Members who meet two key qualifiers will enjoy Ambassador benefits.

Scroll Right for More Data

Partners |

Ambassadors |

|

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||

|

||

|

||

|

||

|

||

| View disclosures | ||

What happens to my Certificate if I don’t extend my rewards?

Your Certificate rate will decrease by .50%, since the bonus Certificate rate will no longer apply.

How do I set up direct deposit?

It’s easy to set up your direct deposit in just a few minutes.

What else does Stanford FCU offer?

Free ATMs

Zelle®

Membership Rewards

Shareholders? Haven’t heard of them. We’re not-for-profit and owned by our members. This means all earnings go back to YOU in the form of lower fees, lower loan rates and higher deposit rates, just for being a member at Stanford FCU!

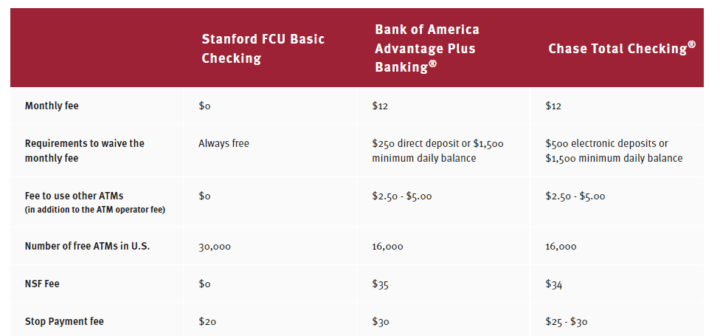

- Free checking (find a spending account with no minimum balance or direct deposit requirements)

- Free ATMs—Ambassadors get unlimited free worldwide ATMs!

- Rewards credit cards with up to 5% cash back and no annual, foreign transaction or balance transfer fees

- Up to 1.00% rate discount on auto and personal loans

Learn how to get the discount

- Earn cash bonuses each time you refer friends, family and co-workers

- High rate Certificates to make your savings grow

- Free financial education and webinars

- Free investment portfolio analysis

Learn more about investments

“The financial advantages at Stanford Credit Union are hard to beat. Their rates and terms consistently outshine those of big banks, which makes saving and growing your money easier and more rewarding. What’s more, the transparency and minimal fees are a breath of fresh air in an industry often known for hidden costs.”

– Wilson L.

Bigger isn’t better when it comes to banking—

see for yourself