Financial Tips

What is a FICO® score?

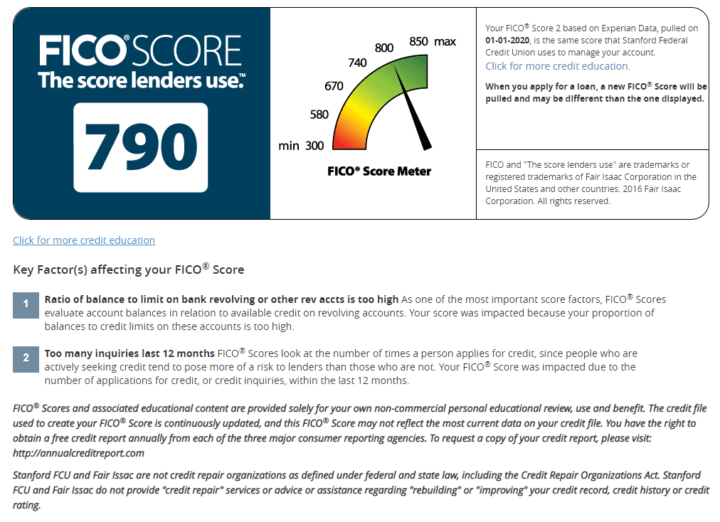

FICO® Scores are the most widely used credit scores. Each FICO® Score is a three-digit number calculated from the data on your credit reports at the three major consumer reporting agencies—Experian, TransUnion and Equifax. Your FICO® Scores predict how likely you are to pay back a credit obligation. Lenders use FICO® Scores to help them quickly, consistently and objectively evaluate a potential borrower’s credit risk.

What your FICO® Score means to lenders:

800 or higher: Indicates an exceptional borrower

740–799: Indicates a very good borrower

670–739: Scores in this average U.S. range are considered good

580–669: Some lenders will approve borrowers with this score

579 or less: Indicates a poor borrower

FICO® Scores are calculated from the credit data in your credit report. The data is gathered from lenders who send details about your loans and credit cards to the consumer reporting agencies. This data is grouped into the five categories below. The percentage shows the importance of each category.

1. 35% – Payment history: Whether you’ve paid past credit accounts on time

2. 30% – Amounts owed: The amount of credit and loans you are using

3. 15% – Length of credit history: How long you’ve had credit

4. 10% – New credit: Frequency of credit inquires and new account openings

5. 10% – Credit mix: The mix of your credit, retail accounts, installment loans, finance company accounts and mortgage loans

You can get a free copy of your credit report from each of the three major consumer reporting agencies annually. To request a copy of your credit report, visit annualcreditreport.com. Please note that your free credit report will not include your FICO® Score. Because your FICO® Score is based on the information in your credit report, it’s important to make sure that the credit report information is accurate (mistakes are common).

Interested in learning more? Visit our Financial Education webpage for articles, tips, and more!