Free checking

We're so confident you'll love us, we're giving you up to $620!*

Open a Stanford FCU checking (spending) account to earn up to $620 in cash or gift cards when you complete simple activities like setting up direct deposit and signing up for eStatements. View disclosures.

Everyday Spending Account

- Totally free checking account

- No monthly fees or minimum balance

Ask a representative about Bank On, part of a national coalition that connects consumers with safe, affordable accounts.

- Totally free checking account

- No monthly fees or minimum balance

Ask a representative about Bank On, part of a national coalition that connects consumers with safe, affordable accounts.

High Yield Spending Account**

- No monthly fees or balance requirements!

- Earn a high yield on all balances up to $100,000 when you meet the monthly qualifications:

- Combined payroll direct deposits of at least $5,000 and a minimum $1,000 spent on your combined debit and credit cards.

More Features

Free ATMs

Zelle®

Membership Rewards

Shareholders? Haven’t heard of them. We’re not-for-profit and owned by our members. This means all earnings go back to YOU in the form of lower fees, lower loan rates and higher deposit rates, just for being a member at Stanford FCU!

- Free checking (find a spending account with no minimum balance or direct deposit requirements)

- Free ATMs—Ambassadors get unlimited free worldwide ATMs!

- Rewards credit cards with up to 5% cash back and no annual, foreign transaction or balance transfer fees

- Up to 1.00% rate discount on auto and personal loans

Learn how to get the discount

- Earn cash bonuses each time you refer friends, family and co-workers

- High rate Certificates to make your savings grow

- Free financial education and webinars

- Free investment portfolio analysis

Learn more about investments

“The financial advantages at Stanford Credit Union are hard to beat. Their rates and terms consistently outshine those of big banks, which makes saving and growing your money easier and more rewarding. What’s more, the transparency and minimal fees are a breath of fresh air in an industry often known for hidden costs.”

– Wilson L.

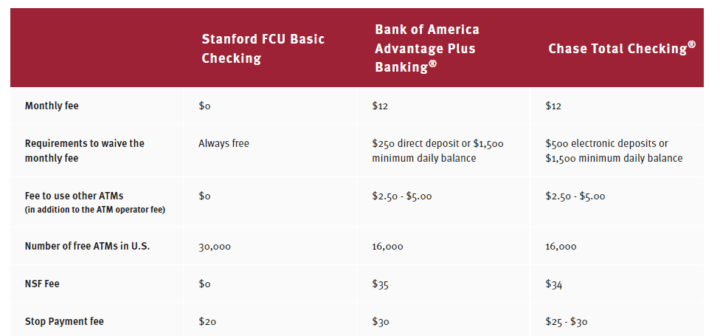

Bigger isn’t better when it comes to banking—

see for yourself

*Open a Stanford FCU Everyday or High Yield Spending account beginning 2/20/25, activate the Cashback+ offers in Digital Banking, then complete each task within your new member period to earn the assigned reward. Tasks and rewards are subject to change without notice. Offer is not available to existing members. The rewards will be credited to your Cashback+ wallet within 35 days from satisfaction of the requirements. The 3-month new member period begins on the first day of the month following your account open date.

Offer does not apply to second or multiple spending accounts and/or existing members with spending accounts, and will be limited to one bonus per household. The spending account must remain open a minimum of three months. Any taxes due on the bonus deposit are the sole responsibility of the recipient. Stanford FCU will report the bonus deposits to the appropriate state and federal agencies, as required by applicable law. This offer is not valid with any other Stanford FCU promotional offer, and is subject to change without notice. Membership eligibility required.

**High Yield Spending Account interest is determined on the last day of each preceding month. If all requirements are met by month-end, then the interest will be paid at the current Qualified Rates up to $100,000 and > $100,000 on the average daily balances on the last day of the following month based on the average daily balance of the account for that month. If the requirements are not met by the last day of the preceding month, then the interest will be paid at the current Non-Qualified Rate on the last day of the following month based on the average daily balance of the account for that month. Limit one High Yield Spending account per primary member. Monthly Requirements to earn the Qualified Rate: (a) receive at least $5,000 in combined payroll direct deposits in the member’s Stanford FCU accounts, and (b) spend a minimum $1,000 on the member’s combined Stanford FCU debit and credit cards with the same primary account owner as the High Yield Spending Account. Payroll direct deposit is defined as recurring ACH payments from your employer or the Social Security Administration. Other deposits such as checks, transfers, Venmo, Zelle® and PayPal do not qualify. Deposits and purchases must post by the last day of each month to qualify. Grace period: During the first two months of opening a new High Yield Spending Account the interest will be earned at the current Qualified Rate, and the account requirements at the end of the second month will be used to determine the rate paid on balances in the third month. Existing checking accounts that convert to a High Yield Spending Account will not have a grace period.