Financial Tips

Getting started Investing

This information is provided for educational purposes only, and is not intended as investment advice.

Investing in the stock market can feel a bit scary, and you should definitely do research to ensure that you’re headed in the right direction. The stock market is volatile—it can go up and down. So before you begin making investments, remember that you may lose your principal. You will also pay fees for your investments, and they can sometimes eat away at your earnings. If you’re currently living on a tight budget, it may be too soon for you to start investing.

Before you even consider investing, financial experts recommend that you pay off high-interest debt and have 3-6 months of expenses available in a savings account in case of an emergency. You never know when you might be laid off or have an unexpected and expensive car repair or medical bill.

Always remember that life happens, and don’t spend more money on your investments than you can truly afford. It’s better to start small and increase your investments over time.

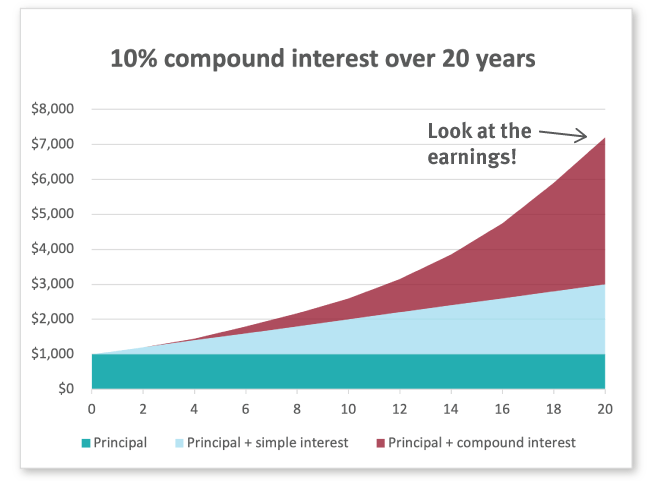

Time can be your enemy or your friend, because the younger you are when you start investing, the more time you have for your investments—however small they may be—to harness the power of compound earnings and grow substantially.

Compound earnings simply means that you’re earning not only on your initial investments, but also on the earnings. If you start investing for retirement before you turn 30, you’ll have 40 years of compound earnings working to maximize every penny. The chart below shows the huge benefit of compound interest over 20 years vs. simple interest with no compounding.

Next, think about your investment goal. Are you saving for a large purchase like a house? Planning to send your kids to college? Hoping to retire young (or at least well-financed)? Your goal will help determine how much risk you can take to maximize your earnings.

If your goal is retirement and you work for a company with a 401(k) matching plan, be sure to take advantage of any additional money they’re willing to deposit into your retirement account by putting a portion of your pre-tax paycheck into the 401(k). A 401(k) is a type of investment account, and you can learn more about investing by navigating around the site and viewing your investment options.

If your investment goal is shorter term, you need to be more cautious about the type of investments you make to ensure you don’t lose your principal before you need the funds. A high-yield savings account like a Certificate or a low-risk investment would be a better option.

It’s a good idea to diversify your investments, so if something doesn’t go well, you have other investments that continue earning. Here are the most common types of investments:

Stocks – These are ownership shares in an individual company, also called equities. Depending on the company, one share can cost anywhere from one dollar to thousands of dollars.

Bonds – This is a loan to a corporation or government that will be repaid over time with interest. Bonds generally earn less than stocks, and they’re less risky.

Mutual Funds – These are a mix of stocks and bonds into one investment package to reduce the risk that might occur by investing in one company. Mutual Funds can be managed by a professional or follow a specific stock market index. Most 401(k) plans are comprised of managed Mutual Funds.

Exchange Traded Funds – ETFs are similar to Mutual Funds in that they represent a mix of investments. They trade throughout the day like a stock, and the share price can be lower than a Mutual Fund.

In addition to online investment options, some financial institutions provide a free, first-time investment counseling review to help you determine your investment strategy. This can be helpful when you have a little money saved to start investing.