- Dedicated Personal Bankers

- New members get up to $620 in cash or gift cards when you complete simple activities like setting up direct deposit and signing up for eStatements!1

- $500 mortgage fee discount2 (RSUs included in underwriting)

Learn more about mortgages - Emergency Loan up to $2,0003

- 0.5% APR discount on auto loans4

- Exclusive Stanford Alumni Rewards Visa Credit Card with a $250 cash bonus point offer5

Welcome Stanford alums

Stanford Federal Credit Union is a full-service bank serving members in 90 countries with one important difference, we’re non-profit and owned by our members. Join today and get up to $620 in cash or gift cards!1

Your Personal Banker

Benefit summary video

Exclusive benefits for Stanford alums

Stanford FCU has been serving Stanford alums since 1985. More than 7,200 alums are already credit union members.

“More than once, SFCU helped me on my financial journey when other banks and credit unions wouldn’t. Also, good interest rates, good customer service and convenience, benefits go to the members instead of just bank executives and the super wealthy.”

—Alissa S.

Stanford alum

We’re non-profit and owned by our members, so all earnings are returned back to members

in the form of lower fees and loan rates, and higher deposit rates.

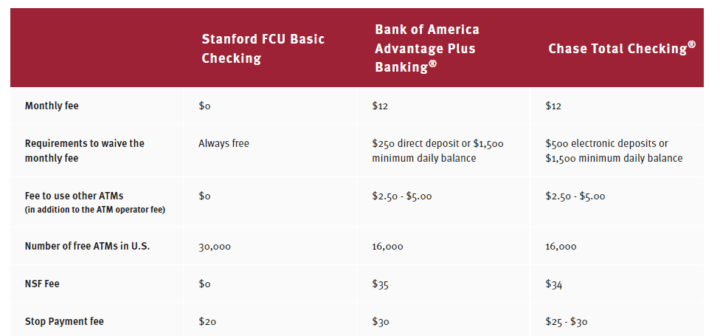

- Free checking with a free first box of checks for new members (no balance or direct deposit requirements)

- Free ATMs on our Locator page—Ambassadors get unlimited free worldwide ATMs!

- Rewards credit cards with up to 5% cash back and no annual, foreign transaction or balance transfer fees

- Up to 1.00% rate discount on auto and personal loans

Learn more about membership rewards

- Free financial education and webinars

- Earn extra cash by referring friends, family and co-workers (refer 5 friends, get $2,500*)

- Free investment portfolio analysis

Learn more about investments - We saved our members $25 million in 2020—view the full reportopens PDF file from the Credit Union National Association (CUNA)

“Stanford FCU doesn’t have a lot of fees to reduce or waive, because we barely charge any fees. And we don’t usually offer special rates, because our everyday rates are already amazing.”

—Joan Opp

Stanford FCU President/CEO

Bigger isn’t better when it comes to banking—

see for yourself